Azimuth Capital Management is a truly independent investment management firm—a level of independence which is increasingly rare today. Our entire organization is structured to align our interests with those of our clients.

Our Unique Characteristics

The level of independence that defines Azimuth is unique in our industry. Our professionals are accountable only to our clients and to ourselves as owners—we aren’t conflicted by the incentive for compensation by any outside party. Our decisions on behalf of clients are driven by one thing alone: what we feel is best for the client.

From day one, our management team has had a very strong belief that the three critical components of money management—decision-making, custody and trade execution—should be completely independent and serve as checks and balances to one another. We manage money for our clients; we don’t custody it, and we aren’t broker dealers. This leads to better outcomes for clients.

From day one, our management team has had a very strong belief that the three critical components of money management—decision-making, custody and trade execution—should be completely independent and serve as checks and balances to one another. We manage money for our clients; we don’t custody it, and we aren’t broker dealers. This leads to better outcomes for clients.

A Better Model of Investing

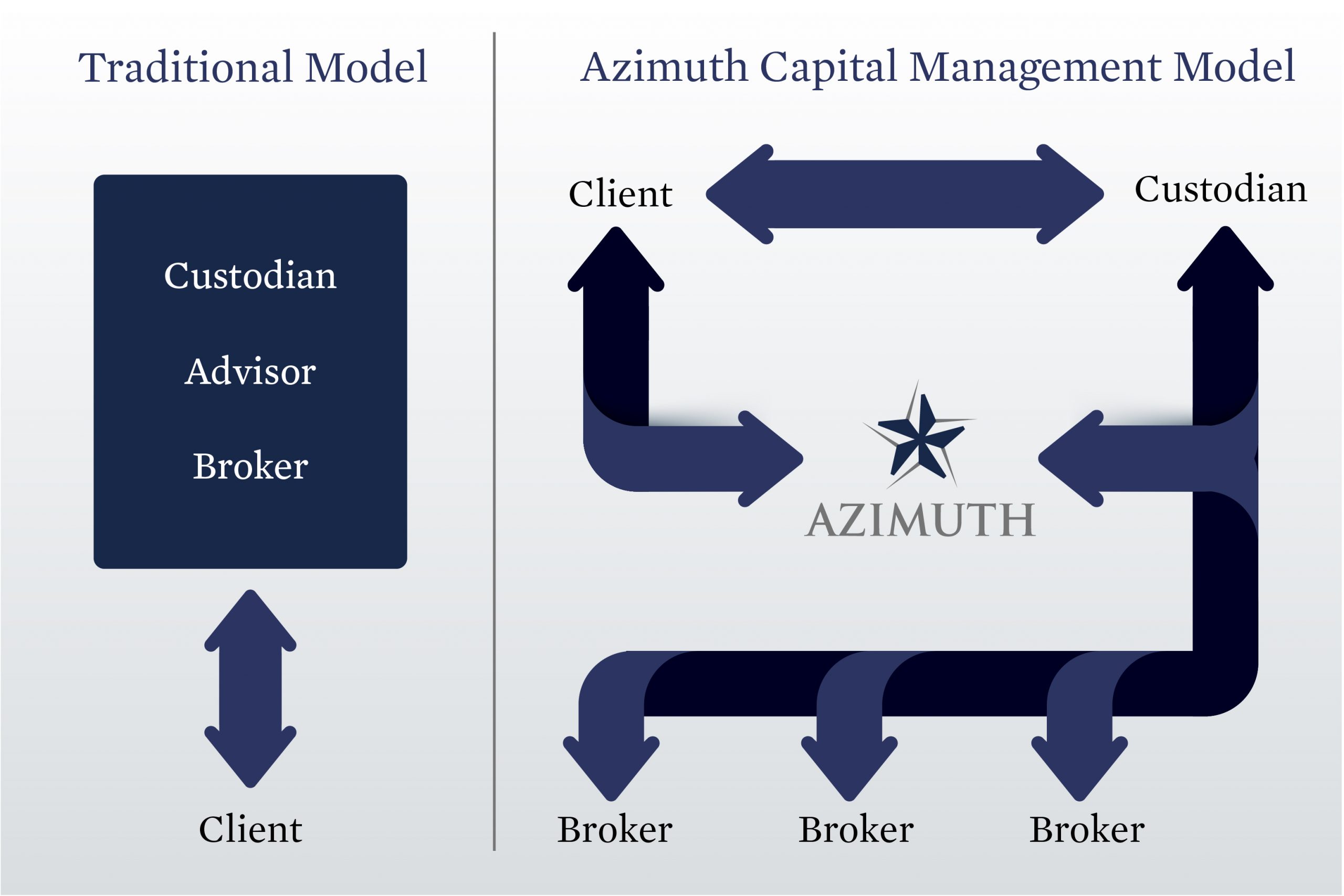

We believe our approach to investment management is more client-centric relative to the traditional broker-dealer model. The traditional model takes a more siloed approach—brokerage, custody, and investment management are often handled by one provider. Azimuth’s model, on the other hand, is built on an open architecture that we believe benefits our clients.

In our model, clients have a contractual relationship with the custodian(s) of their choice, allowing them to reconcile our reporting with the custodian’s reporting—a valuable check and balance. And because we operate our own trading desk and manage orders across multiple executing brokers, we aren’t captive to a single solution. This means we can seek out the best possible execution for our clients, which lowers trading costs and provides a level of anonymity that is critical for many of our clients.

In our model, clients have a contractual relationship with the custodian(s) of their choice, allowing them to reconcile our reporting with the custodian’s reporting—a valuable check and balance. And because we operate our own trading desk and manage orders across multiple executing brokers, we aren’t captive to a single solution. This means we can seek out the best possible execution for our clients, which lowers trading costs and provides a level of anonymity that is critical for many of our clients.

We Invest in You

Our management team comprises experienced professionals, each with unique qualifications, diverse expertise and a meaningful ownership stake in our firm. We invest significant capital alongside our clients across every strategy we employ. We are fully committed to serving your needs in an unbiased manner.

We believe it is in our clients’ best interests to have best-in-class advisors across the following key areas: investment, estate, tax, and insurance. We feel strongly that these roles should be completely separate but able to collaborate, because it provides checks and balances and helps to limit conflicts of interest. Our goal isn’t to earn more of your wallet share through multiple business lines. Instead, we focus on delivering exceptional investment management and financial advice, and we partner with your other key advisors to achieve your financial objectives.

We believe it is in our clients’ best interests to have best-in-class advisors across the following key areas: investment, estate, tax, and insurance. We feel strongly that these roles should be completely separate but able to collaborate, because it provides checks and balances and helps to limit conflicts of interest. Our goal isn’t to earn more of your wallet share through multiple business lines. Instead, we focus on delivering exceptional investment management and financial advice, and we partner with your other key advisors to achieve your financial objectives.